IFTA Fuel Tax Permits and Reporting in New York

Overview

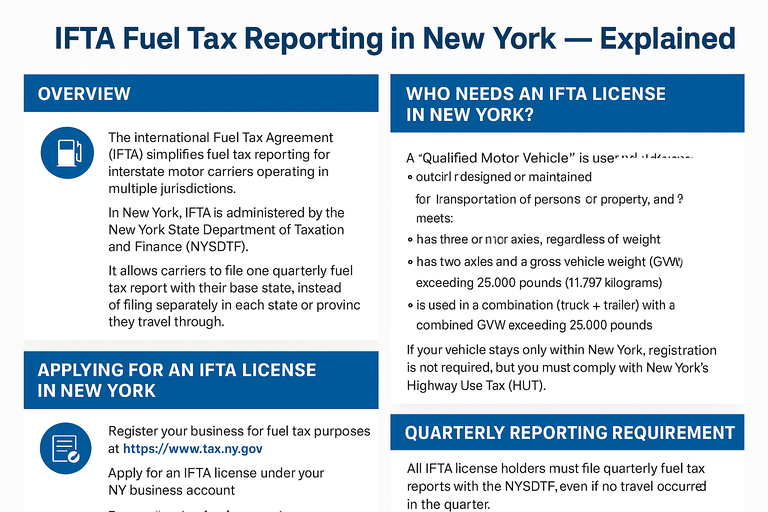

The International Fuel Tax Agreement (IFTA) simplifies fuel tax reporting for interstate motor carriers operating in multiple jurisdictions.

In New York, IFTA is administered by the New York State Department of Taxation and Finance (NYSDTF).

It allows carriers to file one quarterly fuel tax report with their base state, instead of filing separately in each state or province they travel through.

Who Needs an IFTA License in New York?

You must obtain an IFTA license if your business operates one or more qualified motor vehicles that travel in more than one IFTA member jurisdiction.

A “Qualified Motor Vehicle” is:

-

Used, designed, or maintained for transportation of persons or property, and

-

Meets any of the following criteria:

-

Has three or more axles, regardless of weight

-

Has two axles and a gross vehicle weight (GVW) exceeding 26,000 pounds (11,797 kilograms)

-

Is used in a combination (truck + trailer) with a combined GVW exceeding 26,000 pounds

-

If your vehicle stays only within New York, IFTA registration is not required — but you must comply with New York’s Highway Use Tax (HUT).

Applying for an IFTA License in New York

To apply, you’ll register through the New York State Department of Taxation and Finance:

Steps:

-

Register your business for fuel tax purposes at

https://www.tax.ny.gov -

Apply for an IFTA License under your NY business account.

-

Pay the application fee (usually a few dollars per set of decals).

-

Receive:

-

One IFTA license (kept in the cab of each vehicle)

-

Two IFTA decals (placed on each side of the vehicle cab)

-

Temporary IFTA Permit

If you are not IFTA-licensed but need to travel through New York temporarily, you can obtain a Temporary IFTA Fuel Permit instead of registering fully.

-

Valid for: 30 days

-

Available through: www.newyorktruckingonline.com

-

Cost: Around $100–$250

Quarterly Reporting Requirements

All IFTA license holders must file quarterly fuel tax reports with the NYSDTF, even if no travel occurred in the quarter.

Reporting Periods:

| Quarter | Reporting Period | Due Date |

|---|---|---|

| 1st Quarter | Jan 1 – Mar 31 | Apr 30 |

| 2nd Quarter | Apr 1 – Jun 30 | Jul 31 |

| 3rd Quarter | Jul 1 – Sep 30 | Oct 31 |

| 4th Quarter | Oct 1 – Dec 31 | Jan 31 |

What to Report:

-

Total miles traveled (in each IFTA jurisdiction)

-

Total gallons of fuel purchased and used

-

Fuel type (diesel, gasoline, etc.)

-

Net tax owed or credit balance

Filing Method:

-

Online filing: Through the New York State Department of Taxation and Finance online services portal

-

Recordkeeping: Keep mileage and fuel purchase records for at least 4 years

Penalties

Failure to file reports or pay due taxes may result in:

-

$500 minimum fine or 10% of tax due (whichever is greater)

-

License suspension or revocation

-

Additional interest on unpaid balances

Key Takeaways

-

IFTA simplifies multi-state fuel tax reporting for truckers.

-

New York IFTA licenses are issued by the Department of Taxation and Finance.

-

Quarterly reporting is mandatory, even for zero-operation quarters.

-

Keep accurate mileage and fuel records for compliance.