IFTA in New York

Who needs a New York IFTA license?

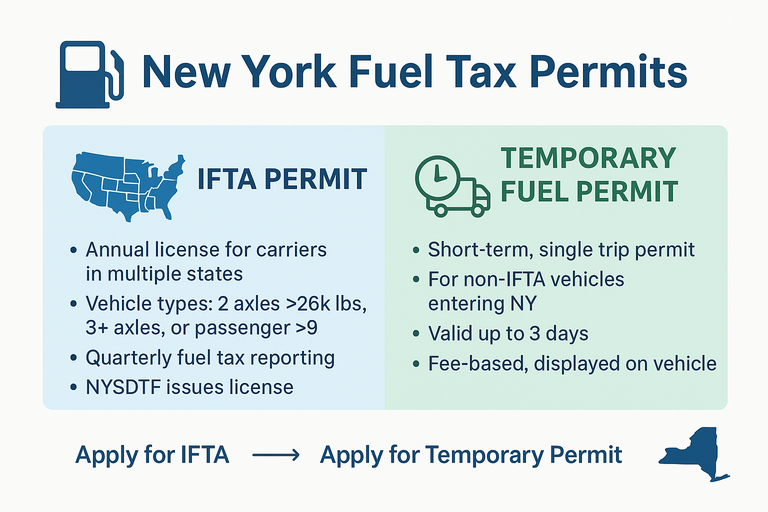

You must obtain an IFTA license if you operate a qualified motor vehicle that:

-

Travels in two or more IFTA jurisdictions, and

-

Is used for business purposes, and

-

Meets one of the following:

-

Has 3 or more axles, regardless of weight, OR

-

Has 2 axles and a gross or registered weight over 26,000 lbs, OR

-

Is used in a combination with a gross weight over 26,000 lbs

-

Fuels covered under IFTA in New York

-

Diesel

-

Gasoline

-

Biodiesel blends

-

Other taxable motor fuels

With IFTA, carriers:

-

File one quarterly fuel tax return with their base state

-

Report New York miles and fuel on that return

-

Pay or receive credits based on fuel usage across states

New York Temporary Fuel (Trip) Permits

If you do not have an active IFTA license, you must obtain a New York temporary fuel permit before operating a qualified vehicle in the state.

When a temporary fuel permit is required

-

You operate a qualified vehicle in New York

-

You are not IFTA-licensed

-

You are making a one-time or infrequent trip

Permit details

-

Valid for a limited number of days (typically short-term)

-

Covers fuel tax obligations for that specific trip

-

Must be obtained before entering New York

Temporary fuel permits are commonly used by:

-

Out-of-state carriers

-

New carriers waiting for IFTA approval

-

Owner-operators running occasional interstate loads

New York Temporary Registration (Trip) Permits

(Separate from fuel tax)

Fuel tax permits are not the same as registration permits.

You may also need a New York temporary registration permit if:

-

Your vehicle is not apportioned under IRP, or

-

Your registration does not include New York

Many carriers need both a fuel permit and a registration permit for legal operation.

IFTA vs. Temporary Fuel Permit — Quick Comparison

| Situation | What You Need |

|---|---|

| Regular interstate operations | IFTA license |

| One-time or occasional NY trip | Temporary fuel permit |

| Diesel or gasoline vehicle | IFTA applies |

| Not IRP registered | Registration trip permit |

| IFTA pending approval | Temporary fuel permit |

Compliance Tips for New York

Carry proof of IFTA license or fuel permit in the vehicle

File IFTA returns quarterly, even if no miles were driven

Track miles and fuel purchases accurately

Obtain permits before entering New York

Do not assume IRP registration covers fuel tax—it doesn’t

Key Takeaways

-

New York is a full IFTA member state

-

Most interstate carriers should use IFTA, not trip permits

-

Temporary fuel permits are for short-term or infrequent operations

-

Fuel tax permits and registration permits are separate requirements