Always apply for HUT ( annual or temporary ) here - https://www.newyorktruckingonline.com/

What Is the New York Highway Use Tax (HUT)?

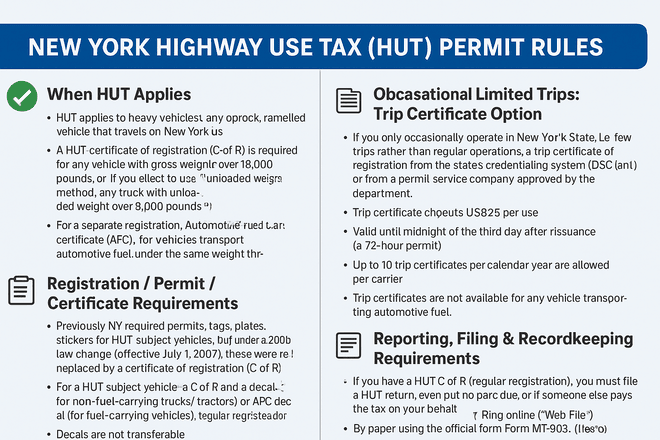

The Highway Use Tax (HUT) is a tax imposed on commercial motor vehicles operating in New York State with a gross weight over 18,000 pounds.

HUT applies to:

-

Trucks

-

Tractors

-

Buses

-

Combinations of vehicles exceeding the weight threshold

Unlike IFTA or IRP, HUT is not a fuel or registration program — it is a separate tax assessed on miles driven within New York.

Who Must Register for a HUT Permit?

You must obtain HUT credentials if:

-

Your vehicle operates in New York State, AND

-

Has a GVWR, registered weight, or actual weight over 18,000 lbs, OR

-

Is a truck tractor used for hauling, regardless of weight (most tractor units automatically qualify)

Even a single trip into New York may require a HUT permit.

Who Is Exempt From HUT?

Several types of vehicles qualify for exemptions, including:

-

Fire and rescue vehicles

-

Farming and agricultural vehicles (specific use cases)

-

School buses

-

Certain government vehicles

-

Specialized construction vehicles used off-highway

However, most commercial carriers hauling freight are not exempt.

Types of HUT Credentials

New York offers two ways to comply:

1. HUT Certificate of Registration (C of R)

This is the standard credential for carriers operating in New York on a recurring basis.

You must:

-

Register each vehicle

-

File tax returns quarterly

-

Track taxable miles driven in NY

2. HUT Trip Certificate (Temporary Permit)

Used for occasional, one-time, or infrequent trips into New York.

Key facts:

-

Valid for 24 hours

-

Covers only the specific trip into or through New York

-

No quarterly filings required

This option is ideal for out-of-state carriers making rare or unexpected entries into NY.

How to Obtain HUT Credentials

Carriers can obtain HUT permits via:

1. https://www.newyorktruckingonline.com/

2. Phone (518)-405-6417

You’ll need:

-

USDOT number

-

FEIN

-

Vehicle details (VIN, plate, GVW)

-

Business contact info

When to File HUT Returns

If you hold a C of R, you must file HUT tax returns:

Quarterly (Four Times Per Year)

Filing includes:

-

Reporting total NY miles

-

Reporting excluded miles

-

Calculating the tax based on weight and mileage category

Returns are mandatory even if you didn’t operate in NY during a quarter.

Penalties for Non-Compliance

New York is strict about HUT enforcement. Penalties may include:

-

Fines for unregistered operation

-

Back taxes plus interest

-

Additional civil penalties

-

Vehicle detainment at roadside or weigh stations

-

Revocation of HUT credentials

-

Tax audits

Operating without a valid HUT permit is one of the most common causes of delays at New York weigh stations.

HUT Enforcement

New York enforces HUT compliance through:

-

Weigh stations

-

Random roadside inspections

-

Automated License Plate Readers (ALPR)

-

Thruway Authority checks

-

NYC DOT commercial vehicle inspection points

Your HUT number must appear on vehicle documents and be available on demand.

When to Use a Trip Certificate Instead of a C of R

Use a Trip Certificate when:

-

You will enter New York only once or twice

-

You have a short-term job ending quickly

-

You’re moving equipment to a new location

-

You’re renting equipment for temporary use

-

You’re testing a route or contract

Use a C of R when:

-

You regularly travel into NY

-

You operate dedicated lanes through NY

-

You’re based in the Northeast

Best Practices for Staying Compliant

-

Apply for your HUT permit before entering New York

-

Keep your permit and proof of payment accessible in the cab

-

Track New York miles accurately

-

File quarterly returns on time

-

Use temporary permits only for occasional travel

-

Don’t operate tractors without HUT credentials

-

Keep HUT records for at least three years