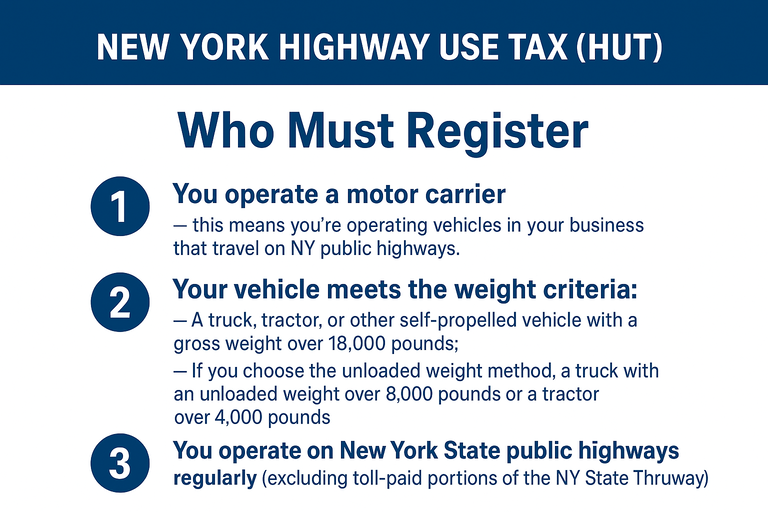

Specifically, HUT registration is required if:

-

You operate a motor carrier — this means you’re operating vehicles in your business that travel on NY public highways.

-

Your vehicle meets the weight criteria:

-

A truck, tractor, or other self-propelled vehicle with a gross weight over 18,000 pounds; or

-

If you choose the unloaded weight method, a truck with an unloaded weight over 8,000 pounds or a tractor over 4,000 pounds.

(The unloaded weight method can affect which vehicles must be registered when elected for reporting.)

-

-

You operate on New York State public highways regularly (excluding toll-paid portions of the NY State Thruway).

If all of the above apply, you must register, get your certificate and decals, and file HUT returns (typically quarterly).

Exceptions & Alternatives

Even if your vehicle is heavy, you might not need to register if:

-

You only occasionally operate in NY — in that case, you may obtain a trip certificate of registration instead of full registration.

-

The vehicle is excluded (e.g., certain buses or highway construction vehicles used for their intended purpose) or exempt (e.g., emergency vehicles, farm vehicles used exclusively for exempt activity, etc.).

If the vehicle is excluded or exempt and is used only for the exempt purpose, you generally don’t need full HUT registration. However, if you use it outside that exempt activity, you must register and pay HUT on all use.

Other Important Points

-

Each vehicle subject to HUT that you operate must have its own certificate and decal.

-

You must file regular HUT tax returns if you hold a certificate, even if no tax is due.

-

If you lease vehicles, the responsibility to register and file may fall on you as the lessee or the owner, depending on who holds the HUT credential.

How to Register

You can register via https://www.newyorktruckingonline.com/, and open your NY HUT Account, receive an link for your NY HUT Personal Cabinet, and you are good to go, decals will be send to your mailing address.