Who Must Pay HUT?

You are required to register for HUT if you operate:

-

Any truck, tractor, or truck-tractor with:

-

Gross vehicle weight (GVW) over 18,000 lbs, OR

-

Gross combination weight (GCW) over 18,000 lbs if towing a trailer.

-

-

Fleet operators who have multiple vehicles, even if each vehicle individually doesn’t exceed 18,000 lbs, may still have HUT obligations depending on mileage.

Note: HUT applies to vehicles traveling on New York highways, even if your business is based out of state.

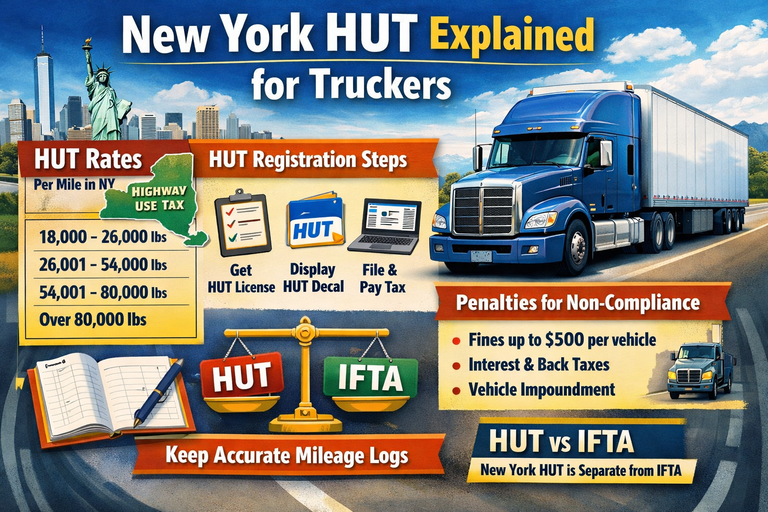

How is HUT Calculated?

The tax is based primarily on the number of miles traveled in New York State. Rates vary depending on vehicle weight. As of 2025, the general approach is:

| Vehicle Weight | Rate per Mile (approx.) |

|---|---|

| 18,000 – 26,000 lbs | $0.075 per mile |

| 26,001 – 54,000 lbs | $0.095 per mile |

| 54,001 – 80,000 lbs | $0.155 per mile |

| Over 80,000 lbs | $0.270 per mile |

Exact rates should be confirmed with the NY Department of Taxation and Finance, as they are updated periodically.

Tip: Keep a detailed log of your mileage in New York to ensure accurate tax reporting.

HUT Registration

-

Obtain a NY HUT Account:

Register online via https://www.newyorktruckingonline.com/ -

Display HUT Decals:

Each registered vehicle must display a HUT license plate decal on the front of the vehicle.

Reporting and Payment

-

Filing Frequency: Quarterly (or monthly for large fleets).

-

What to Report: Total miles traveled in New York and total miles traveled outside NY (for multi-state apportionment).

-

Payment Methods: Online at https://www.newyorktruckingonline.com/, or by calling (518) 405-6417

Important: Underreporting mileage can result in penalties and interest.

Penalties for Non-Compliance

Failing to register, pay, or report HUT can lead to:

-

Fines of up to $500 per vehicle per violation

-

Additional interest on unpaid tax

-

Vehicle impoundment in severe cases

HUT vs. IFTA

-

IFTA (International Fuel Tax Agreement): Covers fuel taxes across multiple states.

-

HUT: Specific to New York and applies in addition to IFTA if your vehicle operates in New York.

-

Most carriers registered under IFTA still need separate HUT registration for New York.

Tips for Truckers

-

Maintain accurate mileage logs and fuel receipts.

-

Register all vehicles that may operate over 18,000 lbs in NY, even if temporarily.

-

File and pay on time to avoid penalties.

-

Review rate tables yearly — HUT rates are subject to change.

https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/hut/introduction.htm